YOUR Financial Freedom

Is Within Reach

YOUR Financial Freedom

Is Within Reach

Debt is the #1 Cause of Stress in the U.S.

Download Your FREE E-BOOK:

Restore Your Credit and Raise Your FICO Score in 4 Easy Steps

NOW

Fail to Plan... Plan to FAIL

Debt is the #1 Cause of Stress

in the U.S.

Download Your FREE

50-30-20 Budget Planner NOW

Fail to Plan... Plan to FAIL

Car Payments

Between 2008 and 2018, there was more than $500 billion worth of car payments made late in America.

Credit Cards

American consumers are carrying over $1 TRILLION in credit card debt.

Student Debt

Americans owe a collective $1.56 trillion in student loans.

Mortgages

At the end of 2018, American mortgage debt reached $15.4 trillion.

Medical Bills

In 2018, nearly 100% of medical bills over $3,000 did not get paid in full.

Car Payments

Between 2008 and 2018, there was more than $500 billion worth of car payments made late in America.

Credit Cards

American consumers are carrying over $1 TRILLION in credit card debt.

Student Debt

Americans owe a collective $1.56 trillion in student loans.

Mortgages

At the end of 2018, American mortgage debt reached $15.4 trillion.

Medical Bills

In 2018, nearly 100% of medical bills over $3,000 did not get paid in full.

Unlock the Power of a Good Credit Score!

Imagine the freedom and opportunities that come with a great credit score! Beyond just lower interest rates, a stellar credit score opens doors to better housing options, exclusive credit card perks, and so much more. Here's why you should be excited about boosting your credit score:

Save Thousands on Major Purchases

A high credit score can significantly lower your interest rates on mortgages and car loans, saving you thousands over the life of your loan. For instance, on a $300,000 home, you could save at least $200 per month with a top-tier interest rate.

Easier Access to Credit

Higher scores improve your chances of getting approved for loans and credit. No more worries about being denied financing for essential purchases.

Better Housing Opportunities

Landlords prefer tenants with good credit scores, which can mean lower security deposits, longer lease terms, and the best rental properties.

Lower Insurance Rates

In many states, a good credit score can lead to lower auto insurance premiums, putting more money back in your pocket.

Exclusive Credit Card Rewards

Enjoy the best perks and rewards with high-limit credit cards that offer cash back, travel rewards, and lower interest rates, all reserved for those with excellent credit.

Favorable Utility and Telecom Terms

Good credit can help you secure financing for new devices and get utilities set up without hefty deposits or guarantees.

Leverage in Loan Negotiations

Use your high credit score to negotiate better loan terms. Competing lenders may offer lower rates or waive fees to earn your business.

Maintaining a good credit score is your key to unlocking these incredible opportunities and more. Ready to transform your financial future? Get your free copy of "Restore Your Credit and Raise Your FICO Score in 4 Easy Steps" now and take the first step towards financial freedom!

Unlock the Power of a Good Credit Score!

Imagine the freedom and opportunities that come with a great credit score! Beyond just lower interest rates, a stellar credit score opens doors to better housing options, exclusive credit card perks, and so much more. Here's why you should be excited about boosting your credit score:

Save Thousands on Major Purchases

A high credit score can significantly lower your interest rates on mortgages and car loans, saving you thousands over the life of your loan. For instance, on a $300,000 home, you could save at least $200 per month with a top-tier interest rate.

Easier Access to Credit

Higher scores improve your chances of getting approved for loans and credit. No more worries about being denied financing for essential purchases.

Better Housing Opportunities

Landlords prefer tenants with good credit scores, which can mean lower security deposits, longer lease terms, and the best rental properties.

Lower Insurance Rates

In many states, a good credit score can lead to lower auto insurance premiums, putting more money back in your pocket.

Exclusive Credit Card Rewards

Enjoy the best perks and rewards with high-limit credit cards that offer cash back, travel rewards, and lower interest rates, all reserved for those with excellent credit.

Favorable Utility and Telecom Terms

Good credit can help you secure financing for new devices and get utilities set up without hefty deposits or guarantees.

Leverage in Loan Negotiations

Use your high credit score to negotiate better loan terms. Competing lenders may offer lower rates or waive fees to earn your business.

Maintaining a good credit score is your key to unlocking these incredible opportunities and more. Ready to transform your financial future? Get your free copy of "Restore Your Credit and Raise Your FICO Score in 4 Easy Steps" now and take the first step towards financial freedom!

Industry Disruption

There is a huge debt crisis crippling Americans. For every dollar measured is a father, mother, son, daughter, and/or family suffering .

Author Patrick O’Brien is taking on this market in a no-holds barred attack on the debt industry!

Author: Patrick O'Brien

Industry Disruption

Author: Patrick O'Brien

There is a huge debt crisis crippling Americans. For every dollar measured is a father, mother, son, daughter, and/or family suffering .

Author Patrick O’Brien is taking on this market in a no-holds barred attack on the debt industry!

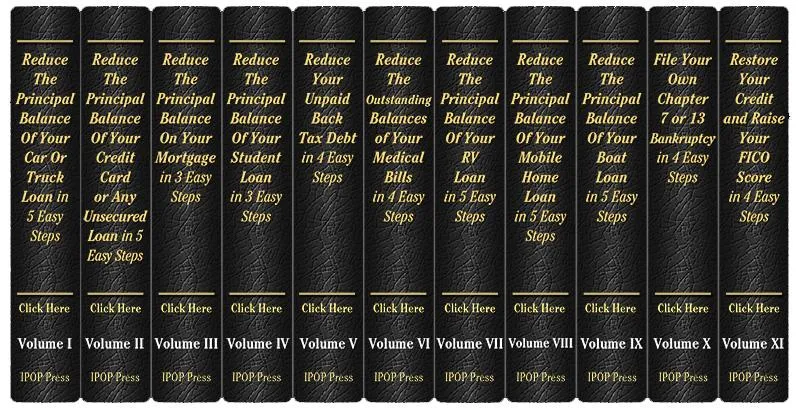

SIMPLICITY is the key to our eBooks. Our eBooks are only available in digital format. All the eBooks were written at a 12-year-old reading level. We also made these eBooks short and to the point. All our eBooks are only between 25 and 72 pages.

All our eBooks can be read in approximately one hour.

SIMPLY PUT, our eBooks teach you how to “Reduce The Principal Balance on your car or truck loan, your credit cards, your mortgage, etc.

Volume I: Reduce The Principal Balance Of Your Car Or Truck Loan in 5 Easy Steps

Volume II: Reduce The Principal Balance Of Your Credit Card or Any Unsecured Loan in 5 Easy Steps

Volume III: Reduce The Principal Balance On Your Mortgage in 3 Easy Steps

Volume IV: Reduce The Principal Balance Of Your Student Loan in 3 Easy Steps

Volume V: Reduce The Principal Balance Of Any Back Taxes in 4 Easy Steps

Volume VI: Reduce The Principal Balance Of Your Medical Bills in 4 Easy Steps

Volume VII: Reduce The Principal Balance Of Your RV Loan in 5 Easy Steps

Volume VIII: Reduce The Principal Balance Of Your Mobile Home Loan in 5 Easy Steps

Volume IX: Reduce The Principal Balance Of Your Boat Loan in 5 Easy Steps

Volume X: File Your Own Chapter 7 or 13 Bankruptcy in 4 Easy Steps

Volume XI: Restore Your Credit and Raise Your FICO Score in 4 Easy Steps

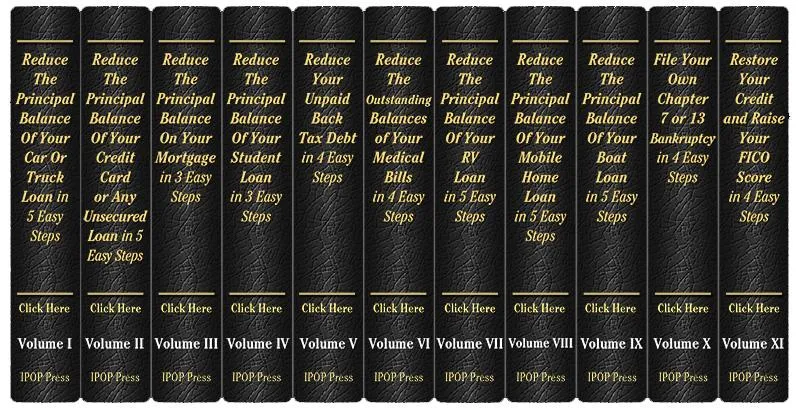

SIMPLICITY is the key to our eBooks. Our eBooks are only available in digital format. All the eBooks were written at a 12-year-old reading level. We also made these eBooks short and to the point. All our eBooks are only between 25 and 72 pages.

All our eBooks can be read in approximately one hour.

SIMPLY PUT, our eBooks teach you how to “Reduce The Principal Balance on your car or truck loan, your credit cards, your mortgage, etc.

Volume I: Reduce The Principal Balance Of Your Car Or Truck Loan in 5 Easy Steps

Volume II: Reduce The Principal Balance Of Your Credit Card or Any Unsecured Loan in 5 Easy Steps

Volume III: Reduce The Principal Balance On Your Mortgage in 3 Easy Steps

Volume IV: Reduce The Principal Balance Of Your Student Loan in 3 Easy Steps

Volume V: Reduce The Principal Balance Of Any Back Taxes in 4 Easy Steps

Volume VI: Reduce The Principal Balance Of Your Medical Bills in 4 Easy Steps

Volume VII: Reduce The Principal Balance Of Your RV Loan in 5 Easy Steps

Volume VIII: Reduce The Principal Balance Of Your Mobile Home Loan in 5 Easy Steps

Volume IX: Reduce The Principal Balance Of Your Boat Loan in 5 Easy Steps

Volume X: File Your Own Chapter 7 or 13 Bankruptcy in 4 Easy Steps

Volume XI: Restore Your Credit and Raise Your FICO Score in 4 Easy Steps

© Copyright 2021 / Secrets2DebtRelief / IPOP Press, Inc.

[email protected] / 760-473-7377

DISCLAIMER: This message does not constitute an offer to sell any securities. The

IPOP Press, Inc. (“IPOP”) offering (the “OFFERING”) is a Reg. D 506(c) offering for accredited investors only. The information presented above and various risk factors are more fully described and qualified in their entirety by IPOP’s private placement memorandum (“PPM”) and other documents related thereto. There is no assurance that IPOP will meet the stated objectives. Actual results and future events could differ materially from those anticipated. Individuals should always conduct their own research and due diligence and engage professional investment advisers as they deem appropriate before making investment decisions. Past results are not necessarily indicative of future performance.